Least expensive plan lacks double-entry accounting reports, bank reconciliation and accountant access. QuickBooks Self-Employed might not be the best choice for an LLC because it lacks important features you might need, including profit and loss reports and 1099 contractor payments. However, it all depends on the needs of your business and may be sufficient for single-member LLCs. In our opinion, it’s only worth it to pay for the tax bundles if you regularly use a CPA for filing your taxes.

Stay on top of business performance with Essentials

Comparing Quickbooks Simple Start to Essentials, you’ll see they essentially offer the same suite of features, but Essentials offers support for more users in slightly larger operations. Salesforce Essentials and Salesforce Professional cater to different business scales, each with unique features and pricing structures. Essentials is aimed at small businesses that need basic CRM tools at an affordable rate. Professional, priced higher, offers advanced functionalities for larger businesses. Salesforce Professional is designed for businesses that have evolved beyond the startup phase and are ready to harness the full potential of a CRM.

- So whether you’re a construction business owner or a bookkeeper, QuickBooks Essentials is tailored to simplify your accounting processes, covering everything from tracking expenses to managing bills.

- It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences.

- Paying your freelancers is also easy thanks to 1099 contractor management features.

- For a one-time $50 fee, a bookkeeper will walk you through the entire setup process.

High pricing

Feature set includes an excellent mobile app and suite of reports, capable invoicing features, plus automated bill and receipt capture through Hubdoc. Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes https://www.business-accounting.net/retail-accounting-how-to-manage-the-accounting-of/ more than 50 reports. If you’d like additional help, there are tutorials available on a wide range of accounting terms, skills and how-tos in our QuickBooks Tutorials section. As for inventory tracking, this feature is also available in the Plus plan.

Odoo: Good for an all-in-one business management app

In this guide, we’ll break down QuickBooks Online pricing, including plans, key features, and alternative platform costs so you can decide which option is best for you. During this period, QuickBooks Essentials played a crucial role in their financial management. Its cloud-based features allowed the team at Wayward Brewing to work remotely and efficiently track inventory, which is critical to adjusting production to meet changing demands. Moreover, QuickBooks Essentials provided essential support in managing the company’s cash flow, which is vital for any small business during uncertain times. It includes all the features of Plus and further enhances them with advanced reporting and analytics, custom user permissions, priority customer support, and allows for up to 25 users.

The mobile apps rank highly with Android users (4.2/5 stars) and iOS users (4.7/5 stars). As far as the quality of customer support, QuickBooks Online users are split. Some users state that they received the help they needed quickly and without any issues.

Advanced Features and Effective Usage

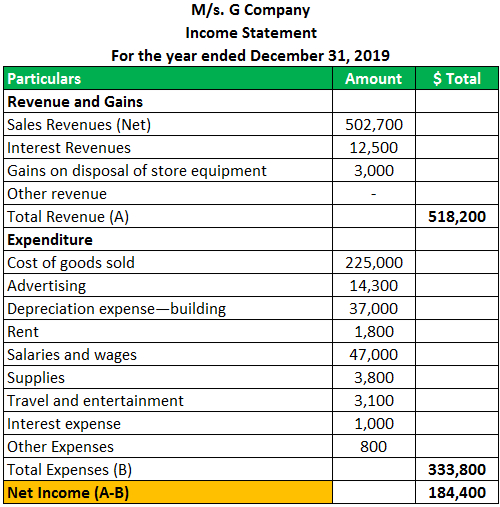

If you’re not registered for VAT and use cash accounting (recording income and expenses when you receive or pay money) go for QBSE. QuickBooks can give you an estimate of your Income Tax and calculate your income and expenses to help you prepare your SA103 form. The figures don’t include partnerships, property income or capital gains.

When comparing QuickBooks Online with two of its top competitors, Xero and FreshBooks, there are some areas where QBO comes out on top. In terms of features, integrations, reporting, and ease of use, QuickBooks holds its own. On the other hand, if you want better customer support or potentially lower pricing, Xero or FreshBooks may be a better fit. Take a look at our comparisons to see how each program stacks up against the others. Though QuickBooks Online has a handful of convenient features that can speed up your workflow and even automate some of it, the software can be complex.

It also gives you access to more than a dozen pre-built financial reports, including a profit and loss statement and balance sheet. Unlike some competitors, none of Zoho Books’ plans put a limit on billable clients, and even its free plan lets you send up to 1,000 invoices per year. On top of that, the free option offers a customer portal, automatic payment reminders, mileage tracking and the ability to schedule reports.

If you want to give QuickBooks a try before buying, you can sign up for a free 30-day trial or use the company’s interactive test drive that’s set up with a sample company. Depending on which product you choose, you will have to make weekly payments plus APR or what is financial ratio analysis other fees. There are other QuickBooks Online charges in addition to the monthly subscription fee. Advanced Inventory is included in the Platinum and Diamond subscriptions only. Advanced Reporting is included in all QuickBooks Desktop Enterprise subscriptions.

Cash-basis accounting means keeping records when you pay or receive money. Accrual-basis accounting records when you get a bill or raise an invoice. QuickBooks Online Simple Start, Essentials, Plus, and Advanced all support both cash and accrual accounting. Ideally, your accounting software will make your day-to-day routine easier through automation. Here are some key factors to consider when researching and choosing the best accounting software for your small business. Strong feature set includes thorough record-keeping, invoicing and advanced inventory management and pricing rules.

NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. You can add QuickBooks Payroll to your existing QuickBooks Online plan. Pricing starts at $37.50 a month plus an additional $5 per paid employee per month. All of QuickBooks’ payroll plans include full-service payroll, which means QuickBooks calculates and files payroll taxes for you. QuickBooks Payroll is one of our favorite payroll companies, so if you’re already using QuickBooks and just hired your first employee, we recommend looking into QuickBooks Payroll.

Set them up once, and QuickBooks will handle the rest on the scheduled dates. You must thoroughly familiarize yourself with the complete QuickBooks Online Essentials dashboard, as this powerful interface provides a quick overview of your business’s financial status. Let’s look closer and compare QuickBooks Essentials with its siblings, including Simple Start, Plus, and Advanced, to help you choose the best fit for your business needs.

When it comes to features and integrations, QuickBooks Online and Xero are pretty evenly matched. However, Xero has a few advantages because it supports unlimited users at no additional cost, making it a solid choice for larger businesses. On the other hand, QuickBooks is easier to learn, has strong mobile apps, and has tax support. QBO has everything you’d expect from accounting or bookkeeping software, including expense tracking, bank reconciliation, journal entries, class tracking, and more. You can create invoices, estimates, purchase orders, and sales receipts. Additionally, there are numerous time-saving automations, such as recurring invoices and auto-scheduling.

Additionally, QuickBooks can be expensive for many businesses, even more so if you add on time tracking or payroll. If you do most of your accounting on the go, QuickBooks Online is one of your best solutions. Of all our top accounting software picks, it has one of the highest-rated mobile accounting apps. The app is basically an all-in-one accounting platform that lets you create invoices, scan receipts, manage expenses, track mileage, and reach out to customers from any web-enabled device. Post-setup, QuickBooks helps you stay on top of your finances with extensive reporting.

This pricing is attractive for startups or small teams that need essential CRM capabilities without a hefty investment. Priced at $80 per user, per month, Professional targets https://www.personal-accounting.org/ businesses with larger budgets and a need for more comprehensive CRM tools. The higher cost reflects its wider array of features suitable for larger, more complex operations.